Good, Fast, Cheap: When market isn’t on your side

Up to now, we discussed your product and your team’s choices in balancing quality, speed, and cost. What about the external reality, which is the market you’re operating in?

You’ve launched new features, talked to customers, shared blog posts, and tested new channels, but nothing seems to move.

It’s frustrating. It’s also a reminder that building a good product is only part of the story. The other part is understanding the forces outside your company that can either help you grow or hold you back.

Table of Contents

External challenges

The reality is, the market doesn’t always cooperate. Even the best product can stumble if the world around it changes or if competitors are pulling customers in other directions.

Here are a few reasons why the market might feel stacked against you:

Too many players

The space is crowded, and every company is competing for attention. Think of how many apps now promise to “simplify your workflow”.

Customer loyalty and inertia

People often stick with tools they already know. Even if yours is better. Switching costs time and effort, and trust is hard to win.

Bigger forces at play

Economic downturns, changing regulations, or shifting trends can suddenly make your business model less attractive…or even impossible.

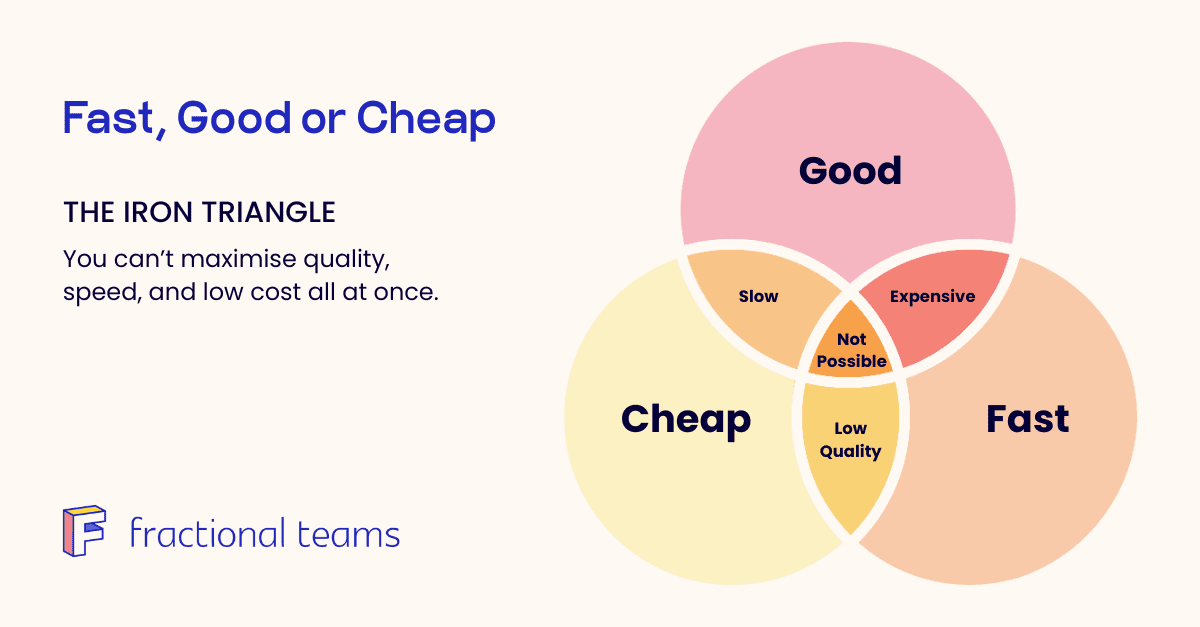

When everyone’s fighting for the same customers, the Good-Fast-Cheap triangle can feel more like a square. External factors often force trade-offs. You may not be able to have all three sides of the triangle at once.

The Slack vs. Teams example

Some companies manage to tip the scales in their favour. Not necessarily because their product is better, but because of how they position it in the market.

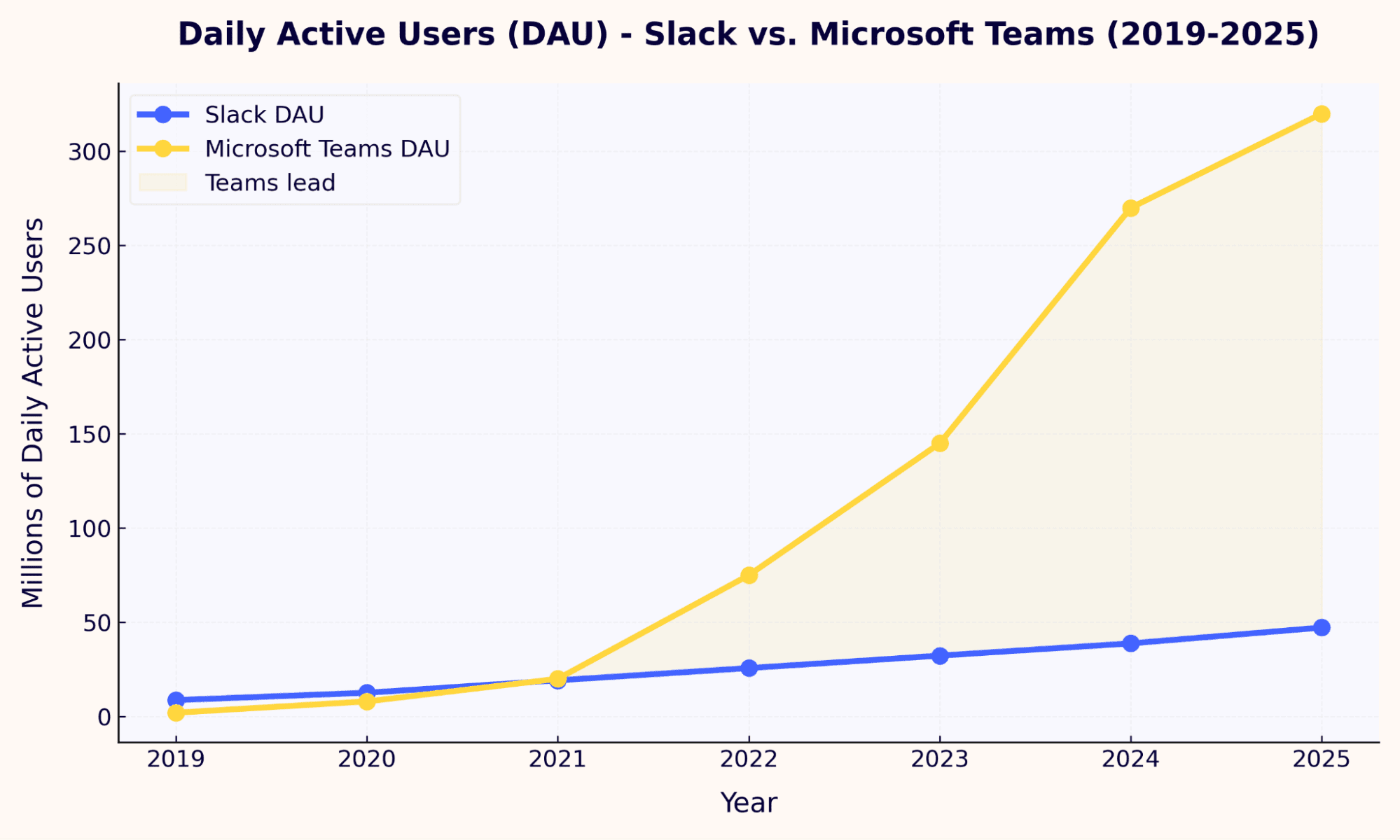

Slack vs. Microsoft Teams shows how external market forces can overtake even a well-loved product.

When Slack arrived, it wasn’t just another chat app. It made work conversations feel lighter and easier. By 2017, Slack had more than 6 million daily active users and was popular with tech companies, startups, and online communities for its:

- Clean, user-friendly interface

- Frequent new features

- Large set of integrations

- Reputation as the “modern” way to work together

Then Microsoft launched Teams in 2017 and played a very different game.

Instead of competing only on product features, Microsoft leaned on its ecosystem, pricing, and existing relationships to shift the market in its favour.

Here’s how they managed it:

1. Selling a broader solution

Slack positioned itself as the best tool for team messaging. Microsoft presented Teams as part of a full work suite covering chat, video calls, file sharing, and built-in connections with Word, Excel, and other apps. For many businesses, this meant one platform instead of juggling separate tools.

Lesson: Offering a complete solution can be more compelling than selling a single feature.

2. Bundling with Microsoft 365

Teams initially came bundled with Microsoft 365 at no extra cost for millions of customers. The question quickly became: “Why pay extra for Slack when we already have Teams included?”

This bundling was a key driver of Teams’ growth. It felt “free,” and IT leaders often defaulted to software already inside their existing subscriptions.

Later, under regulatory pressure in regions like Europe, Microsoft separated Teams from the Microsoft 365 suite, requiring businesses there to purchase it separately. But by then, the strategy had worked: Teams had secured a massive installed base and became the default choice for many organisations.

Lesson: Bundling can effectively grow market share even if regulations force you to unbundle later. Once a product becomes the default, momentum often keeps it ahead.

3. Speaking to decision-makers

Slack grew by appealing directly to the people who use it every day (designers, developers, marketers) who loved its informal, modern feel. Microsoft focused on IT leaders and executives, who cared about security, compliance, and costs.

Lesson: To win large deals, speak to the priorities of those approving budgets, not just end users.

4. Relying on familiarity

Microsoft already had long-standing trust with business customers through Office, Windows, and established contracts. Even if Teams didn’t match Slack feature for feature at first, many IT leaders felt safer choosing a familiar brand.

Slack, while innovative, still felt like a younger, less proven company to some larger organisations.

Lesson: Familiarity builds trust. Companies often choose a good-enough tool from a known player over a better tool from a newer name.

5. Creating network effects

As more companies chose Teams, it became simpler for businesses to work with clients and partners who were already using it. Slack focused mostly on internal team use, without the same network pull across organisations.

Lesson: Products that become more valuable as more people adopt them are much tougher to replace.

6. Using scale and reach

Microsoft had a global sales force, strong ties with CIOs and procurement teams, and far more resources for promoting Teams than Slack could match.

Lesson: A solid product still needs strong distribution and sales channels to succeed.

The Results

By 2024, Microsoft Teams reached 320 million monthly active users, leaving Slack far behind at about 65 million monthly and 42 million daily active users. By 2025, Teams held roughly 37% of the collaboration market, compared to Slack’s 13%.

Slack couldn’t compete on price because it couldn’t match Microsoft’s “free.” And being a “better” tool alone wasn’t enough against Microsoft’s reach and established customer base.

When you mistime the market

Another scenario is building a solid product but mis-timing the market.

Perhaps you created a fantastic solution, but customers aren’t ready to adopt it yet. Maybe the pain point isn’t felt acutely enough, or you’re a bit ahead of the technology curve.

In that case, no matter how high your quality or how fast/cheap you deliver, you’ll struggle to gain traction (you’ll hear crickets after launch).

When demand suddenly spikes (Zoom example)

If market demand spikes due to trends or crises, you might be forced to compromise on one dimension just to keep up.

When remote work exploded in 2020, video conferencing tools had to scale insanely fast. Zoom’s product was good and even fairly cheap, but to meet demand, they had to sometimes prioritise speed of scaling over perfect quality (early on, there were security issues, etc., that they had to fix later).

The market forces dictated the trade-offs.

What to do when the market isn’t playing along

When facing external challenges, your first step should be to listen to the market. It might be telling you that your current approach isn’t working.

Here are ways to adapt:

Differentiate differently

- Can’t win on cheap? Double down on good and become the premium, high-quality choice for customers who care.

- Realise customers don’t need a gold-plated solution? Offer a simpler, cheaper product that meets expectations and delivers speed/cost benefits.

Consider a market pivot

Sometimes, the best move is to shift focus to a more receptive segment:

- Large enterprises not biting?

- Mid-market companies loving your product or a specific feature?

Let the market guide you toward the segment showing the most traction.

Find out where the wind is blowing, and set your sails.

Go where the wind blows (your audience is there)

In simple words, this means going where your audience already is and where your concept naturally gains momentum, instead of fighting against the current.

This applies both to building the right features and to distributing your product.

One aspect of this is being flexible with your product direction. Founders may start out thinking their product will be used a certain way by a certain group, but reality can surprise them.

Smart founders follow the traction

Notice an unexpected subset of users loving your product?

→ Dig in and explore why.

For example, you built a project management tool for marketing teams, but unexpectedly, event planners start using it and adapting it to fit their needs.

That’s a sign: consider focusing on that use case and audience – go where the wind blows.

Look beyond the usual channels

Don’t expect your customer to come find you. Go to the platforms and channels where your customers already gather. This is especially relevant for community-driven growth strategies tied to modern SEO and AI trends.

We explored this in depth in our Grow2Market podcast episode, “Community and content: The real future of SEO and AI”.

Your audience (founders, product managers, developers, etc.) might not be waiting for a sales email or Google ad. Instead, they’re engaging in:

- Niche communities and forums

- Reddit, where many SaaS buyers and influencers have real conversations

- Hacker News from Y Combinator

- Discord groups

- LinkedIn niche groups

- Slack communities

- Industry-specific forums

Reddit is sometimes seen as a risky or “unconventional” marketing channel for B2B, but it’s exactly where many real conversations happen.

If your potential customers are gathering on a subreddit to share tips or vent frustrations, that’s where you need to be engaging.

Get The Ultimate Reddit Playbook

The Reddit Playbook is based on real-world experience with B2B brands. It’s a practical guide for founders, marketers, and sales teams, covering both the basics and advanced strategies for engaging authentically, spotting opportunities, and growing your presence without relying on big ad budgets.

Conclusion

No matter how well-built your product or skilled your team, external factors can throw off your balance between good, fast, and cheap. But those same factors can also reveal where your best chances lie.

If the market’s crowded or timing is off, focus on what you can control: how you position your product, who you target, and where you show up. Sometimes that means pivoting to a different segment, simplifying your offering, or looking into channels others overlook.

When you align your product with places showing genuine interest or unmet needs, you’re building something people want right now instead of relying on guesswork. It’s practically a cheat code for the impossible triangle.

Dariia Panchenko

Hi! I'm Dariia Panchenko, Analytics and Community Manager at Fractional Teams. I write about the best B2B marketing strategies and practices.